Password reset email sent. Please check your email inbox or spam folders. If you have not received an email, please get in contact with us.

Password reset success. Click here to Login.

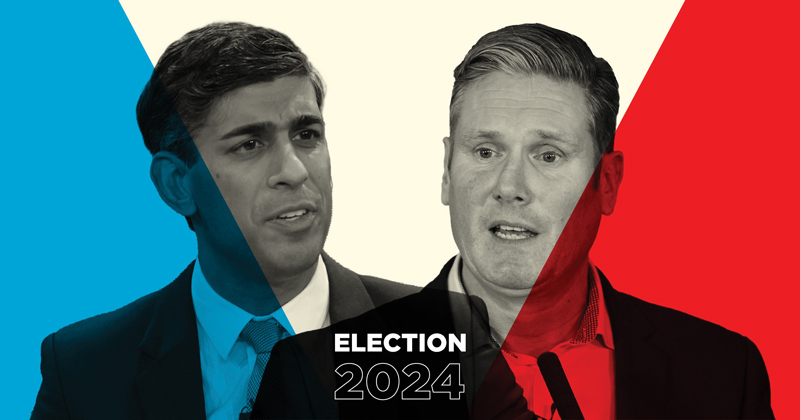

On the 22nd May 2024 the Prime Minister, Rishi Sunak, called for a general election on 4 July 2024 which has set in motion a chain of events which will likely create shifts in market dynamics, economic policies and regulatory changes.

As a business owner this may be an uncertain time, but understanding the implications of this pivotal event is crucial for businesses of all sizes, large and small.

Depending on which party is in power following the general election there will likely be some changes to taxation, regulation and trade which could create waves in an already volatile market and impact future growth and innovation of businesses.

Understanding the potential implications and preparing for them will help your business overcome uncertainty and exploit emerging opportunities.

How can your business prepare? Let’s take a look at some simple steps to undertake in preparation of the general election on the 4th July.

Planning financially for different scenarios and developing strategies to help set aside reserve funds to account of any economic fluctuations would be a sensible move to start making. Also start putting together plans which account for various political scenatios occurring as different political parties have conflicting approaches to corporation tax. Being aware of these and planning for these is important to protect your profitability strategies as a decrease or increase to corporation tax could be particularly impactful to the operating costs of smaller businesses.

To rely on any single market or revenue stream now would be risky and a key focus should be to reduce dependency on single markets or sectors.

As discussed, political parties have differing approaches to corporation tax, and there are several other key areas which could witness changes too such as minimum wage levels and worker rights which could require changes to your HR policy. Stricter environmental policies could also be introduced which would affect sectors including manufacturing, transport and logistics, energy, and construction. Staying up-to-date on the potential changes is vital and implementing plans to account for the potential outcomes and the impact of them on your business is highly recommended.

As the election date comes closer, communicating clearly and maintaining transparency with your employees and customers is important to reassure them that whatever changes the government bring are not going to impact them.

Whilst news of the general election has bought some uncertainty, there are also opportunities for growth, innovation, and investment. Start monitoring any pledges that bring grants or incentives aimed at improving business growth and start thinking about how you may like to upskill your workforce as post-general election there may be training programmes or incentives available.

As we approach the general election on the 4th July there is an inevitable level of uncertainty among business owners and what potential changes could mean for their business, as there will almost certainly be a shift in market dynamics, economic policies and regulations somewhere along the line. However, being prepared for these by developing risk management plans and planning for different outcomes is a key step to help reduce the impact of these on your day-to-day operations. Staying up-to-date on potential changes is pivotal and can help you identify potential opportunities early on which support business growth and investment.

Posted On: May 29, 2024