Password reset email sent. Please check your email inbox or spam folders. If you have not received an email, please get in contact with us.

Password reset success. Click here to Login.

Do you have complete visibility of your cashflow so you can make informed business decisions quickly? Perhaps your business growth is being hindered by your existing software failing to provide adequate financial forecasts, or do you face hurdles from managing multiple currencies?

Opera 3 is a complete financials package. It gives you real-time visibility into your cashflow so you can continually track revenue, and it manages unlimited currencies and exchange rates per transaction for ultra-simplicity. With Opera 3 Financials you can fuel business growth knowing you have all the financial information you need to make timely decisions.

“As a large scale producer in the produce industry, cost control is at the forefront of every business decision. Having a live picture and comprehensive insight into our costs at any point in time is crucial for decision making, minimising waste, and maximising profitability."

“As a large scale producer in the produce industry, cost control is at the forefront of every business decision. Having a live picture and comprehensive insight into our costs at any point in time is crucial for decision making, minimising waste, and maximising profitability."

Tony Bartlett, Alan Bartlett & Sons

The applications available within Opera 3 Financials are:

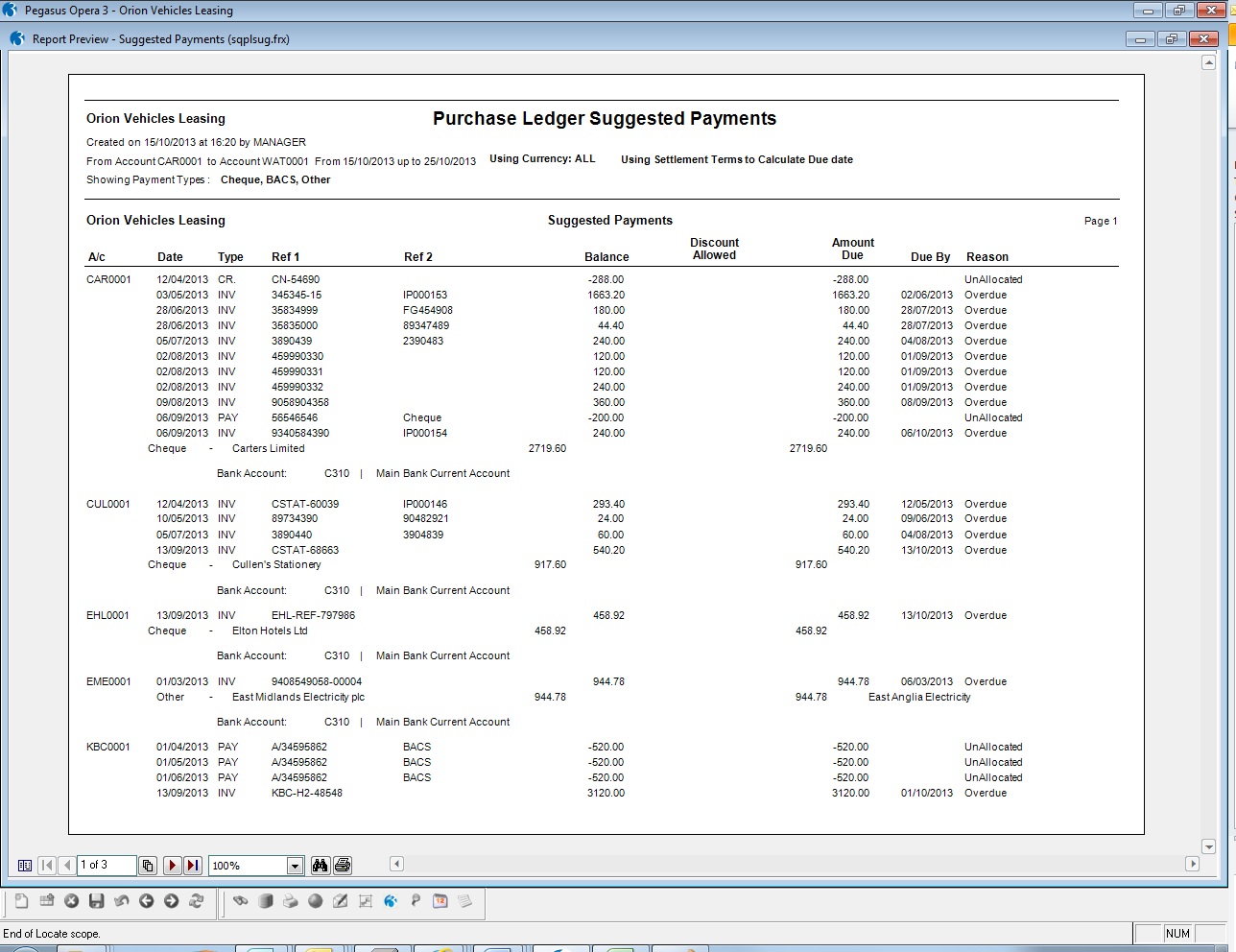

With Opera 3, all your supplier transactions are thoroughly and securely managed from start to finish. Your cash flow is automated and improved with comprehensive cheque and BACS payment routines, e-mail remittances (individual or batched), and the calculation of creditor days.

It gives you dynamic access to purchase information across multiple periods and you can view the information you need in the manner you choose.

The integrated Purchase Invoice Register allows invoices and credit notes to be posted and remain in the register until they are authorised, giving you greater control over every document received. Payment workflow is enhanced though BACS and cheque payment routines combined with e-mail remittance. What’s more, with back-to-back processing to the Fixed Assets application, you can create an Asset record when posting an invoice to save re-keying information.

The Retrospective Creditors report in the Purchase Ledger produces a list of outstanding supplier debts as at a date specified, aged according to the length of time the debt has been outstanding. The report can be printed and output to Excel.

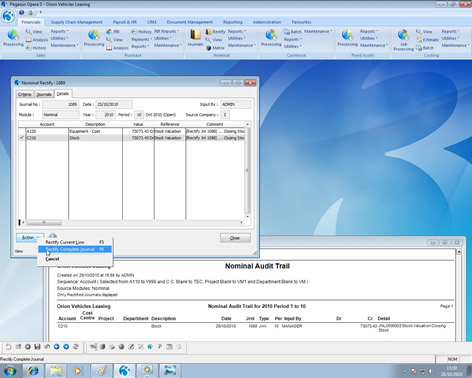

Nominal Ledger includes analysis of Account, Type, Sub-type, Cost Centre plus two further user-definable levels as standard, giving you access and in-depth analysis at transaction level for the past 9 years.

Get management information and reports from Financials, Supply Chain and Payroll & HR. You can apply budgets at all four analysis levels, for current or future periods and years, with full percentage variance analysis and reporting. You can even easily change your year start date and maintain your data integrity.

The Nominal Ledger offers the Open Period Accounting functionality. Transactions can easily be posted from other applications such as Sales, Purchase, Cashbook, and Payroll into any open period of the last, current or next 3 financial years. Other applications post to the Nominal Ledger by either batch update or real-time transfer. Even mis-posted nominal journal entries can be reversed and rectified quickly and accurately.

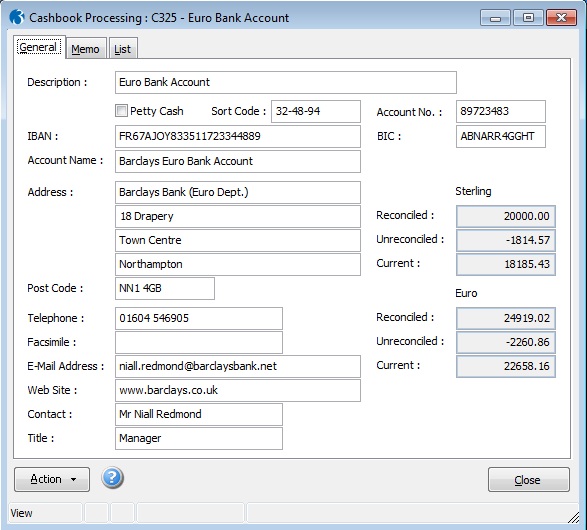

With Cashbook you can post transactions directly from Financials, while the reconciliation function allows you to post unexpected entries, interrogate transactions and save incomplete reconciliations so you can finish them later.

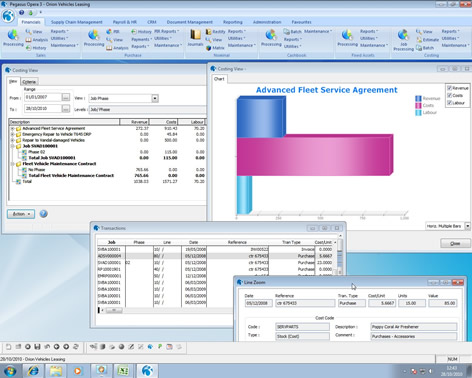

With Opera 3 Costing you can track job costs and revenues against budgets, and you can break down costs against a variety of categories including Labour, Contractor, Direct Expense, Stock and Interim Billing. Group jobs under contract headings or post against option phase, and stay easily in control. Any Timesheets raised for work on jobs can easily be transferred into Payroll to update employee records.

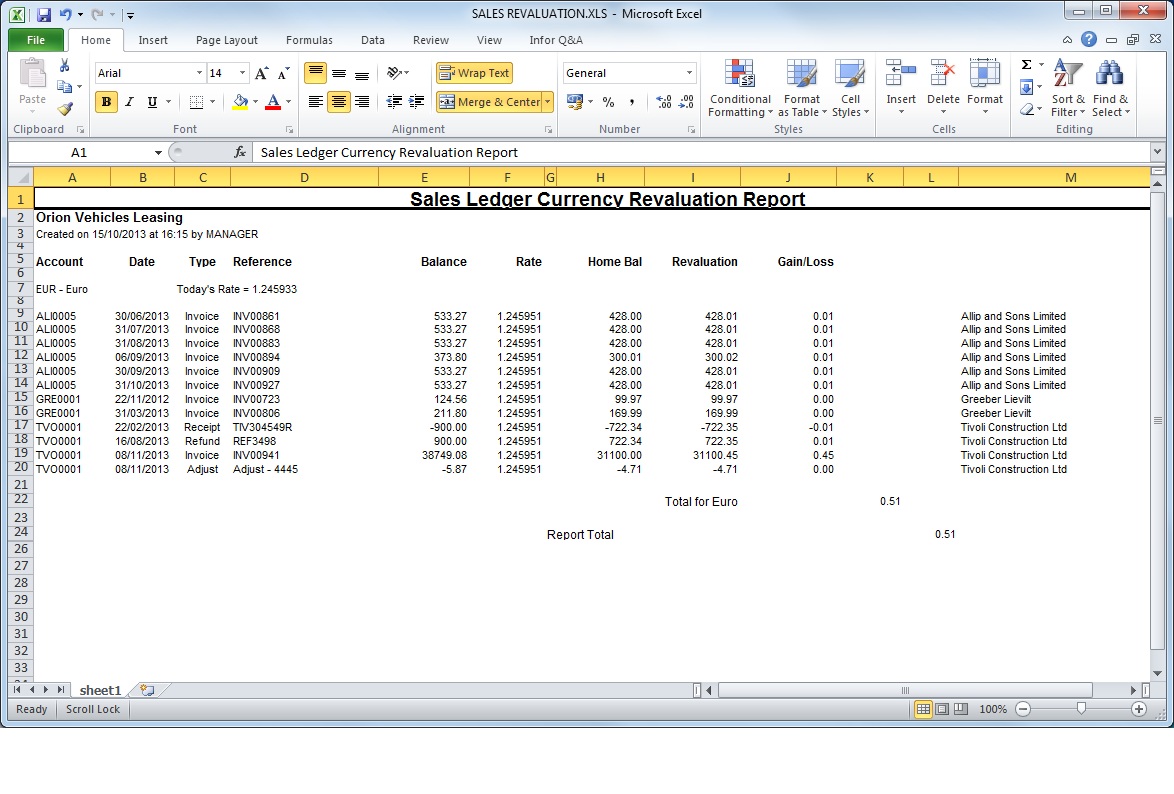

Opera 3 handles unlimited currencies, exchange rates per transaction type and the calculation and recording of exchange rate fluctuations.

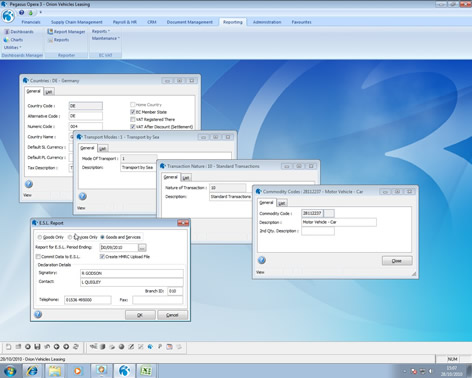

If you trade within the European Union there are complex VAT rules you have to comply with regarding the importing and exporting of goods. These rules can be hard to follow and failure to comply can result in financial penalties. To help you, these complex rules are automatically built into Opera 3 EC VAT to make it easier for you to trade in Europe.

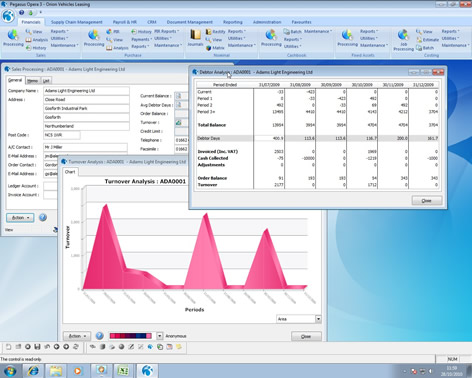

The Sales Ledger has built-in credit control facilities so that customer account information is all at your fingertips. And it makes revenue forecasting easy with the automatic calculation of average debtor days for both individual customers and your entire company.

You can e-mail statements, copy invoices and debtors letters. You can view your sales information in a way that is meaningful to you, as Opera 3 offers Views that you can customise. And of course, it caters for multi-currency and handles all your customer profiles and trading terms, as well as invoices, credit notes, receipts, refunds and adjustments.

The Retrospective Debtors report in the Sales Ledger produces a list of outstanding customer debts as at a date specified, aged according to the length of time the debt has been outstanding. For example, to rerun your Debtors report at 31 December 2010, you simply enter that date and the report calculates the debtors position at that time. The report can be printed and output to Excel.

>Watch the Retrospective reporting video demo

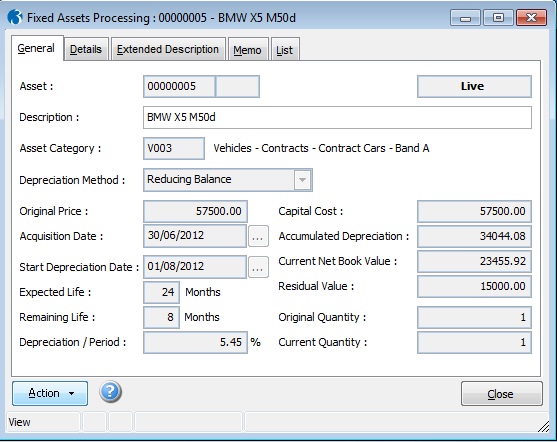

Keep track of your assets from the minute they become part of your company right until you dispose of them. Opera 3 Fixed Assets will track their depreciation rates and maintain the correct net book value for them throughout their life cycle. It caters for all types of assets, including Finance or Operating Lease and Hire Purchase or Lease Purchase assets. What’s more, the import routine makes it simple to import existing asset lists from a spreadsheet in bulk.

| Flexible Chart of Accounts | Account, Type, Sub Type, Cost Centre, Department and Project | |

| Financial Calendar | Define up to 24 periods | |

| Rebuild Periods | Allows period balances to be re-calculated if the Financial Calendar is adjusted during the fiscal year | |

| Dimensional Analysis | Cost Centre, Department* and Project* analysis | |

| Group Analysis | Group together Nominal accounts for additional reporting and analysis | |

| Journals | Reversing, Recurring, Retained (Skeleton) and VAT journals |

|

| Open Period Accounting | Transactions can be easily posted from other applications such as Sales, Purchase, Cashbook, and Payroll into any open period of the current or next 3 financial years. Nominal Journals can be raised to the previous year. | |

| Budgeting | Budgeting at Account, Cost Centre, Department and Project level with import facilities from Microsoft Excel using Pegasus XRL | |

| Private Nominal Accounts | Account details can be restricted to users who have had additional security applied | |

| Real-time or Batch Update | Update Nominal accounts in real time or batch update from source ledgers | |

| Distribution Accounts | Transactions posted to distribution accounts are automatically distributed to cost centres based on defined percentages | |

| Multi-Currency | Nominal accounts can hold both base and currency period to date, year to date and previous year values | |

| Revaluation | Currency bank balances can be re-valued at any time based on current exchange rates | |

| Transaction History | Retain transactions and journal images for up to nine years | |

| User Definable Views* | Define financial management Views with up to six levels of analysis, apply criteria filtering and graphical representation. Report across fiscal years and periods with transactional drilldown and easy export facilities to Microsoft Excel |

|

| Transactional Drilldown | Drilldown through user definable Views or Nominal accounts to period values, transactions and source documents |

|

| Financial Reporting | An extensive range of reports are provided as standard including the ability to define your own management reports (Profit & Loss and Balance Sheet) | |

| Consolidation | Multi-company account consolidation providing group reporting facilities with the ability to consolidate ledgers with different operating currencies | |

| Excel Integration | Information can easily be extracted from Opera 3 into Microsoft Excel with Pegasus XRL | |

| Customisable | The Nominal Ledger can be customised to suit the specific requirements of your business | |

| Context sensitive Help | Comprehensive and easy to use Help facilities | |

| Receipts and Payments | Can be processed in the Cashbook, Sales or Purchase Ledgers | |

| Batch Processing | Batches of Receipts or Payments can be posted together in a single transaction | |

| Cashbook Types | Allows the creation of multiple Cashbook types for Receipts, Payments and Transfers to match how transactions will appear on bank statements | |

| Recurring Entries | Set-up direct debit and standing order entries on a monthly, quarterly or user definable basis | |

| Bank Reconciliation | Includes transactional drilldown, ledger postings, the ability to save a partially completed bank reconciliation and the ability to produce the bank reconciliation listing as per the bank statement |

|

Bank Transfers | Transfer funds from one account to another |

|

BACS and e-Banking | Allows payments to be processed via BACS and banking software | |

Multi-Currency | Create home and currency bank accounts | |

Petty Cash | Create any number of Petty Cash accounts | |

Cheque & Remittance Advice | Allows combined cheque and remittance advice production, to suit your company stationery | |

Matching | Easily match and remove any incorrectly posted transactions which will never appear on the Bank Statement | |

Opening Balances | Individual account set-up is simplified with the Opening Balances routine | |

Transaction History | Reconciled transactions can be retained for up to 99 periods | |

Comprehensive Reporting | An extensive range of reports are provided as standard | |

Account View | Provides reconciled and un-reconciled information, statement number and date range selection, transaction detail, statement line number and paying in slip reference | |

Excel Integration | Information can easily be extracted from Opera 3 into Microsoft Excel with Pegasus XRL | |

Customisable | The Cashbook can be customised to suit the specific requirements of your business | |

Context Sensitive Help | Comprehensive and easy to use Help facilities | |

| Trade in Multiple Currencies | Process transactions in any currency, with values recorded in the base and customers operating currency | |

| Delivery and Head Office | Unlimited delivery accounts with the ability to re-direct invoices and statements to Head Office | |

| Trading Terms | Define trading terms for an individual or a range of customers (eg payment terms, settlement discount and credit limit) | |

| Credit Control | Includes statement production, debtor letters, provision for bad debts, customer debtor days, statistical debtor analysis, customer notes and the ability to place customer accounts on stop | |

| E-mail Integration | Produce customer e-mails, statements and copy invoices, automatically generating a customer note for audit and reporting purposes | |

| Multiple Contacts | Unlimited contacts and the ability to apply up to six attributes against each contact, ideal for marketing campaigns and targeted mailings |

|

Disputed Invoice Analysis | Assign user definable reason codes against disputed invoices, with reporting facilities to highlight any trends and automatic customer note generation |

|

Statistical Debtor Analysis | Includes average debtor days, turnover and Sales analysis for up to 99 periods |

|

Customer Notes | Assign notes to customer records as a reminder or a task for others, with full e-mail integration | |

Dormant Accounts | Exclude any dormant accounts from Sales processing, searches and reports | |

Transaction History | Retain transactions for up to 99 periods | |

Attachments | Attach multiple files (eg spreadsheet, Word document) to a customer account | |

User Definable Views | Define Sales Views with up to six levels of analysis, apply criteria filtering and graphical representation. Report across Sales periods with full transactional drilldown and easy export facilities to Microsoft Excel or Word | |

Transactional Drilldown | Drilldown through user definable Views or sales accounts to transactions and source documents | |

Comprehensive Reporting | An extensive range of reports are provided as standard | |

Excel Integration | Information can easily be extracted from Opera 3 into Microsoft Excel with Pegasus XRL | |

Customisable | The Sales Ledger can be customised to suit the specific requirements of your business | |

Context Sensitive Help | Comprehensive and easy to use Help facilities | |

| Trade in Multiple Currencies | Process transactions in any currency with values recorded in both the base and suppliers operating currency | |

| Ledger Account | Specify an alternative ledger account to receive payments for this supplier eg a factoring house | |

| Trading Terms | Define individual terms or profiles to attach to supplier accounts, including settlement discount rates and supplier payment terms | |

| Suggested and Automatic Payments | Methodical payment routines that allow the progression of payments for suppliers from suggested payments to authorisation and through to generation of cheque and BACS payments |

|

Cheque & Remittance Advice | Flexible design allows the generation of a combined or individual cheque and remittance advice, to suit your company stationery | |

E-mail Integration | Send an email directly from the supplier account using contact information. This will automatically generate a supplier note for audit and reporting purposes | |

Purchase Invoice Register (PIR) | Use PIR to record Purchase Invoices and Credit Notes. Once authorised the transactions can then be posted to the Purchase Ledger to update the accounts and the Purchase analysis files |

|

Held Invoice Analysis | Assign user definable reason codes against disputed Invoices, with reporting facilities to highlight any trends and automatic supplier note generation |

|

Multiple Contacts | Unlimited contacts and the ability to apply up to six attributes against each contact | |

Dormant Accounts | Exclude any dormant accounts from Purchase processing, searches and reports | |

Attachments | Attach multiple files (eg spreadsheet, Word document) to a supplier account | |

Transaction History | Retain transactions for up to 99 periods | |

User Definable Views | Define Purchase Views with up to six levels of analysis, apply criteria filtering and graphical representation. Report across periods with full transactional drilldown and easy export facilities to Microsoft Excel or Word | |

Transactional Drilldown | Drilldown through user definable Views or Purchase accounts to transactions and analysis | |

Comprehensive Reporting | An extensive range of reports are provided as standard | |

Excel Integration | Information can easily be extracted from Opera 3 into Microsoft Excel with Pegasus XRL | |

Customisable | The Purchase Ledger can be customised to suit the specific requirements of your business | |

Context Sensitive Help | Comprehensive and easy to use Help facilities | |

| Contracts, Jobs and Phases | This flexible structure provides extensive control, monitoring and reporting of Contracts, Jobs and Phases | |

| Estimates | Full Estimate processing with budget forecast and Quote production facility. A Job can be created from an Estimate without the need to re-key the information and an Estimate can be used more than once |

|

Cost Types | Use an extensive range of Cost and Revenue cost types including: Direct and Recharge Expense, Labour, Contractor, Stock, Retention, Interim & Final Billing, Overhead and Retention | |

Cost Code Analysis | Create unlimited Cost Codes, linked to Cost Types, to give unlimited analysis of cost and revenue transactions, overheads and budget comparison | |

Cost Rates | Allows up to 999 Cost Rates to be used at Contract or Job level. If a change of rate is required this can be applied at transaction level, applying the appropriate cost from the Cost Code | |

Budgets | Actual and revised budgeting facilities |

|

Revenue | Revenue postings created in Costing can generate detailed Documents in Invoicing or SOP. Choose to Invoice by individual Cost lines, Frameworks, Cost Types or a direct value | |

Integration | Real-time integration with Opera 3 Financials, Supply Chain Management and Payroll & HR means transactions are only required to be processed once | |

Batch Processing | Use Batch Processing to enter batches of Timesheets or Costs for a range of Jobs in one efficient process |

|

Payroll Transfer | Employee Timesheets processed in Costing can easily be transferred to Payroll, saving the need to re-enter the information | |

Frameworks | Group associated Cost Codes and apply to Jobs and Estimates to simplify the budget process | |

Department Analysis | Add further analysis by introducing an optional Department code against Jobs and Estimates | |

Transactional Drilldown | Detailed, multi-level transactional drilldown at Contract and Job level | |

User Definable Views | Define Costing Views with up to six levels of analysis, apply criteria filtering and graphical representation. Report across periods with full transactional drilldown and easy export facilities to Microsoft Excel | |

Global Cost Codes | Provides the ability to perform a global update of Cost Codes, including the option to increase any overhead values | |

Comprehensive Reporting | An extensive range of reports are provided as standard | |

Excel integration | Information can easily be extracted from Opera 3 into Microsoft Excel with Pegasus XRL | |

Customisable | Costing can be customised to suit the specific requirements of your business | |

Context Sensitive Help | Comprehensive and easy to use Help facilities | |

Manage your cash flow, reduce customer debt and improve the overall financial position of your business with Credit Management Centre. It provides a consolidated view of your business so you can quickly see what is owed, who owes it and when, with easy to understand, real-time graphs.

Knowing who owes what and when they will pay is key to managing your customer debts. The Opera 3 Credit Management Centre is designed to improve your credit control processes which will help increase your cash flow, reduce bad debts and improve the financial position of your business. See it in action!