Password reset email sent. Please check your email inbox or spam folders. If you have not received an email, please get in contact with us.

Password reset success. Click here to Login.

Did you know that the average construction project suffers 150% cost overruns and completes more than 175% late? Pegasus CIS 5 helps combat this by giving you complete control of your contracts; you’ll deliver projects on time and within budget and transform your profitability at the same time.

“In order to maintain control over resources and costings it is crucial that we closely track everything in order to identify anomalies, and use the insight to inform future projects. Pegasus CIS is incredibly robust and user friendly, and provides a huge amount of value to us as an organisation. No matter how many projects we ask it to manage it copes seamlessly, and through having access to detailed, up to date information across the board we can act upon red flags and forecast more accurately .”

“In order to maintain control over resources and costings it is crucial that we closely track everything in order to identify anomalies, and use the insight to inform future projects. Pegasus CIS is incredibly robust and user friendly, and provides a huge amount of value to us as an organisation. No matter how many projects we ask it to manage it copes seamlessly, and through having access to detailed, up to date information across the board we can act upon red flags and forecast more accurately .”

James Smith, GMI Construction

CIS 5 now integrates with Opera 3 SQL SE so you can harness the power of both. - Partners Search

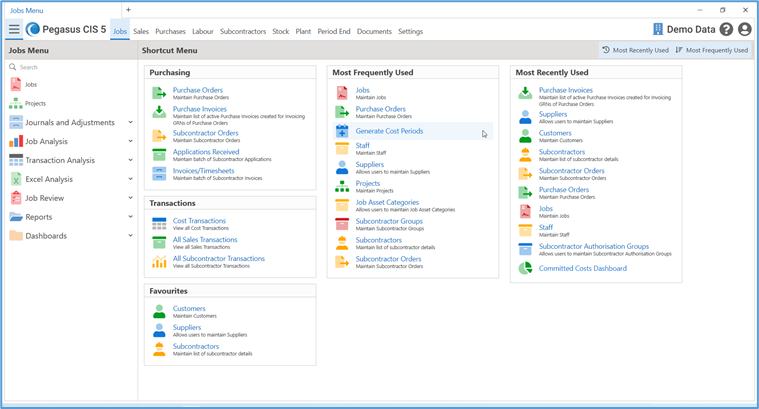

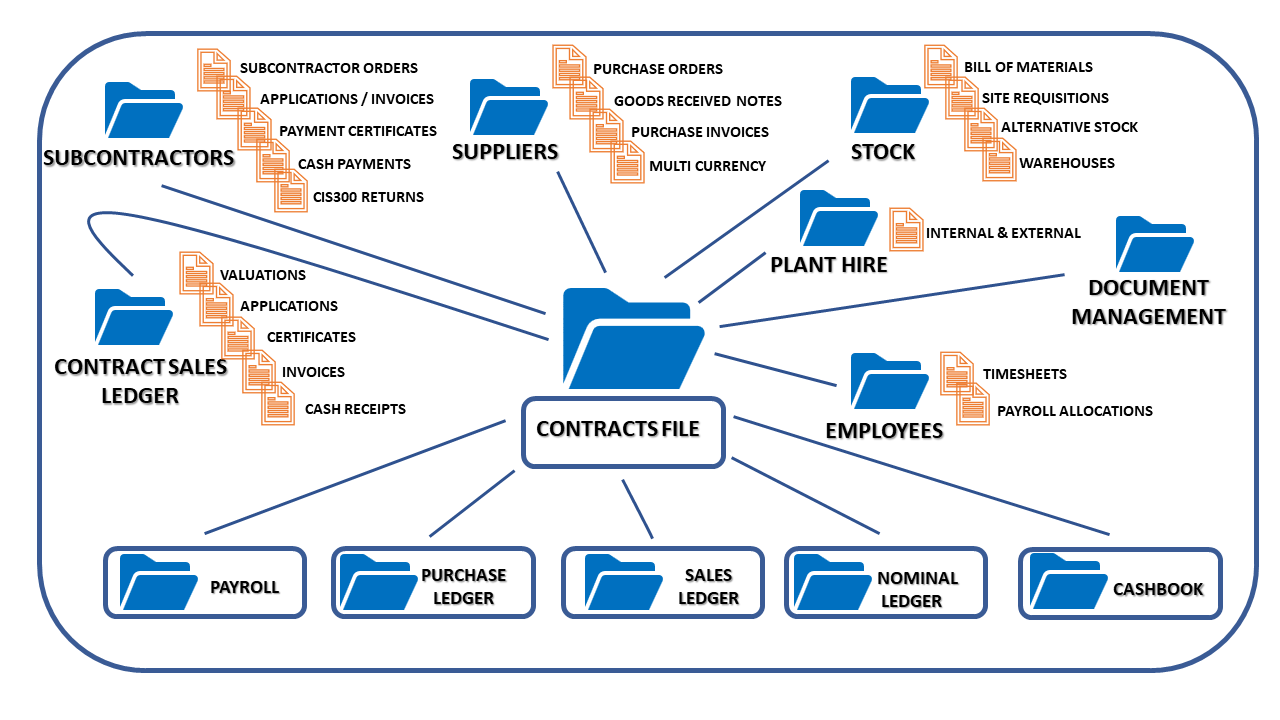

Pegasus CIS 5 provides complete control over all aspects of contracts management, from costing and timesheets through to payment applications, VAT invoicing and cash receipt matching. It is fully integrated with the Sales, Purchase and Nominal Ledgers, Cashbook and Payroll in Opera 3.

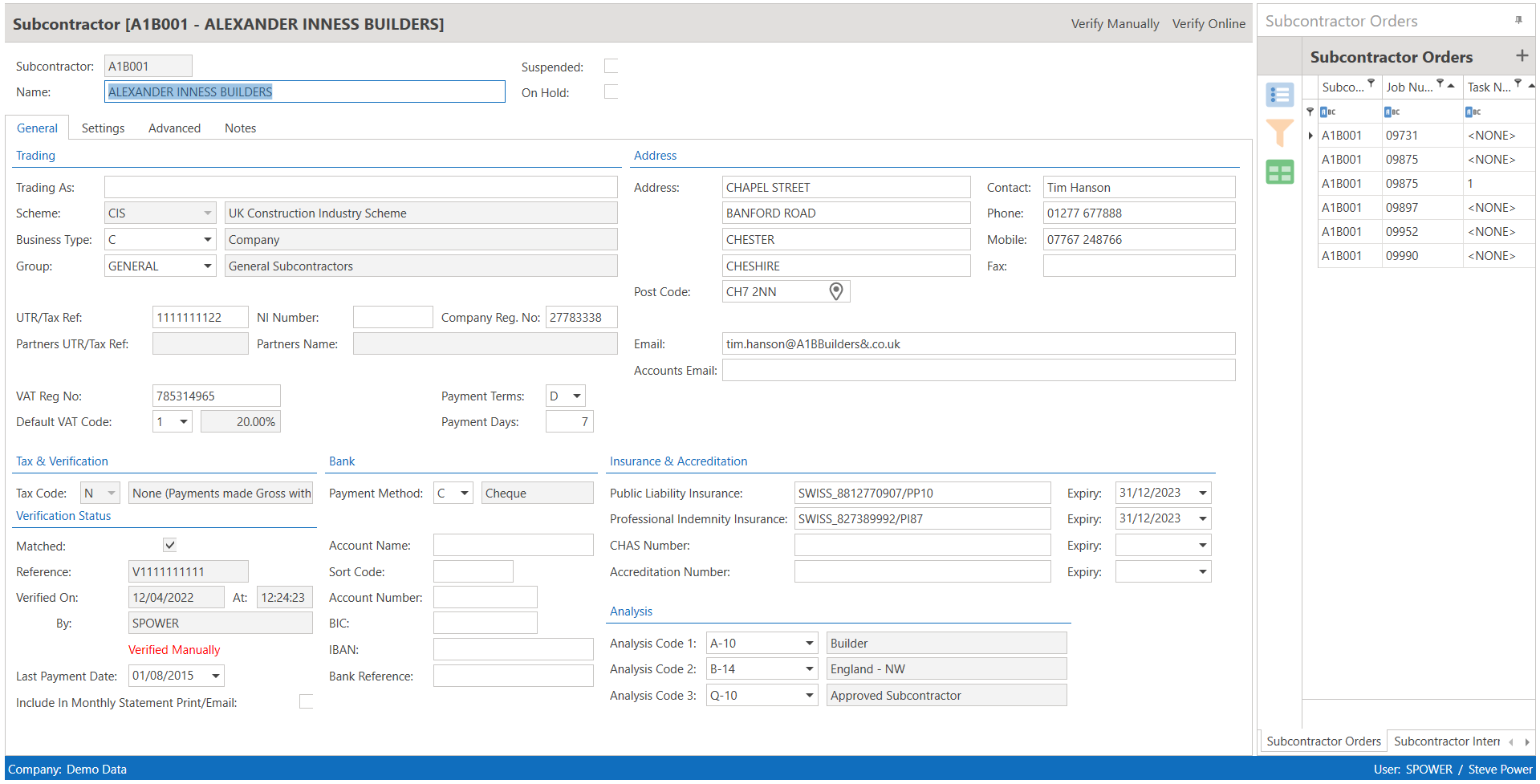

Enhanced information retrieval capability, customisable screen layouts, easy-to-use workstation and multiple tabs for simplicity.

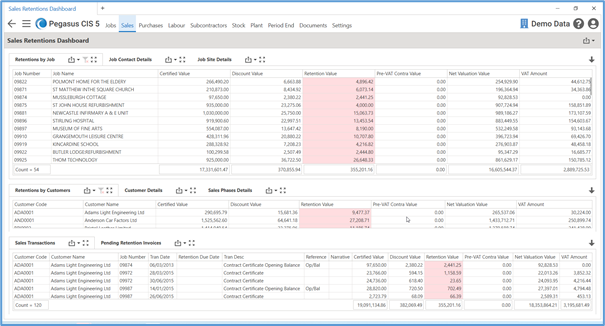

New reporting functionality takes your reporting to the next level, giving you real-time information on all your projects at the click of a button to help you make faster, smarter decisions. With Pegasus CIS 5 you'll get integrated Crystal Reports©, on-screen reporting, integrated dashboards, XRL and Microsoft Excel© integration.

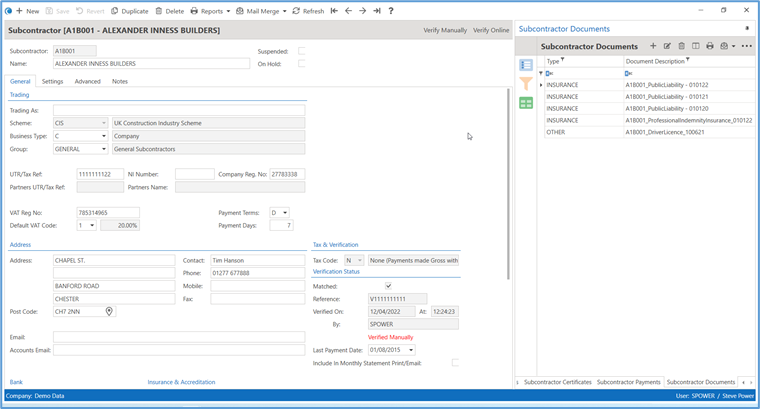

Document Management allows you to electronically store documents against individual contracts. This useful tool improves security, reduces admin costs, saves time and improves your environmental credentials by limiting the number of paper files you hold.

CIS 5 also includes over 100 NEW enhancements! Full details of these can be found in the enhancement guide below.

The following diagram details the main data flow between Pegasus CIS and Opera 3. It is also possible to integrate Pegasus CIS into market-leading accounting solutions including Sage 50, Sage 200 and Sage Payroll.

Electronically store files against individual contracts.

The new XRL application links Pegasus CIS 5 to Microsoft Excel at the click of a button so you don’t need to copy and paste, re-key or calculate formulas. Once in Excel you can delve deeper into your data and share spreadsheets easily throughout your business.

See the status of your projects and finances at the click of a button, with easy-to-view visuals.

A smart reporting wizard to give you even more insight.

Design custom made Dashboards to suit your business.

Controlling your costing on-site with a comprehensive set of Web Apps that can be deployed on mobile devices so that your workforce can directly interact with your Pegasus CIS 5 Costing Systems.

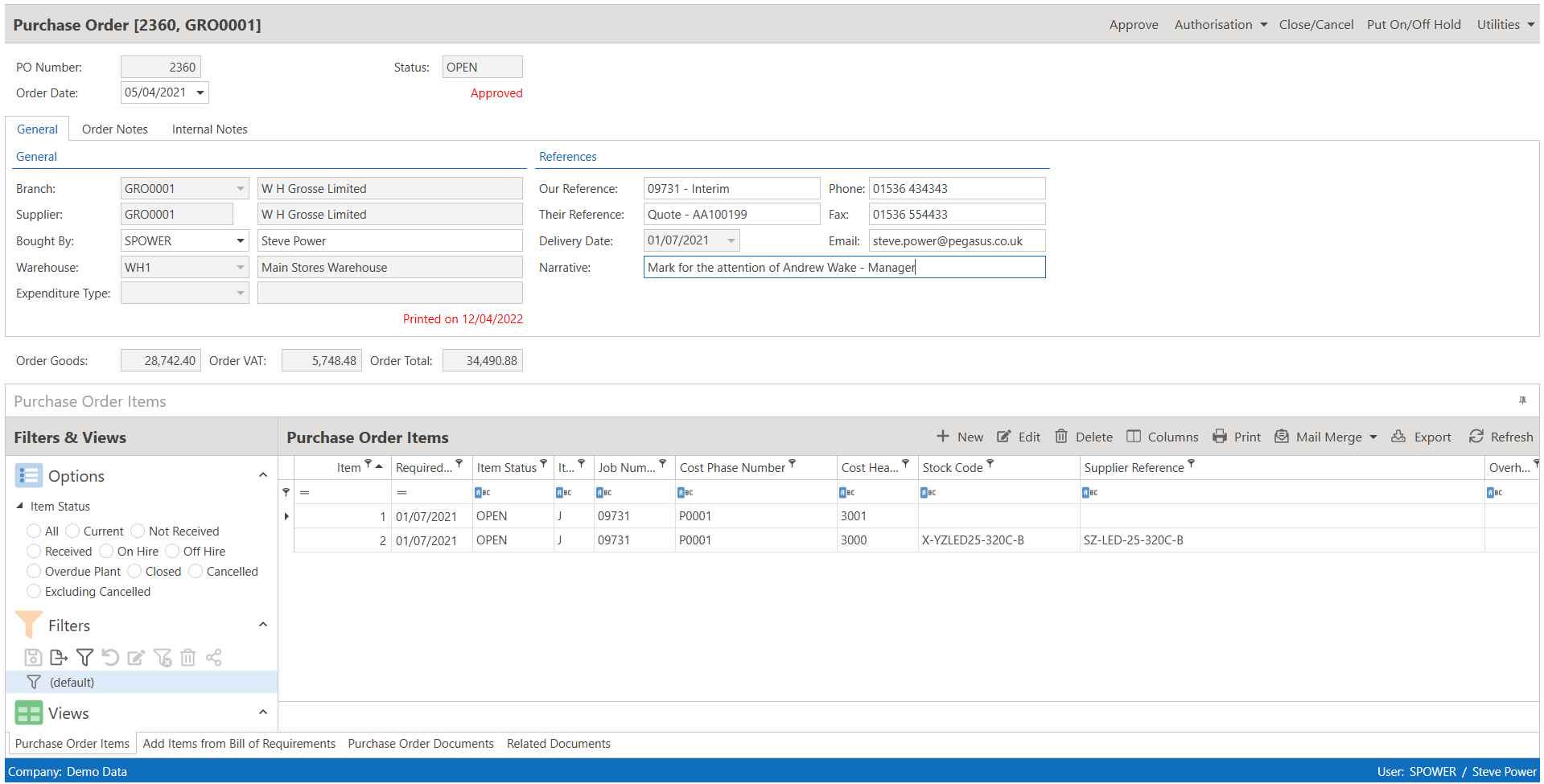

For full control of your purchasing, either on site or at your warehouse & stores. Raise purchase orders, issue them & record those receipts, it even allows you to return them back to a supplier if they are incorrect.

Control receipts and returns of plant that is on a site.

Full control of you stock records from enquiries through to posting to your jobs or transferring between warehouses and sites.

Empower your team to enter their timesheets directly into their mobile devices, allow these timesheets to be approved. Once approved they can be posted into your Pegasus CIS 5 system for those costs to be allocated to your jobs and posted into to the Payroll for your employees to be paid. A fully integrated solution.

Remote authorisation processes allow for an agile approach to running a business, especially where key decision makers are not necessarily office based. Using technology can allow these decision makers to monitor the business and authorise transactions while operating outside the normal office environment. Ideal for many of the modern companies that operate in the construction eco-system within the UK.

We are excited to announce the release of Pegasus CIS 5, our contract costing solution. In this webinar we will walk you through the new product so you can see it in action, and get an overview of all the new and improved features.