Password reset email sent. Please check your email inbox or spam folders. If you have not received an email, please get in contact with us.

Password reset success. Click here to Login.

Did you know at least 60% of SMEs experience late customer payments. Are you one of them?

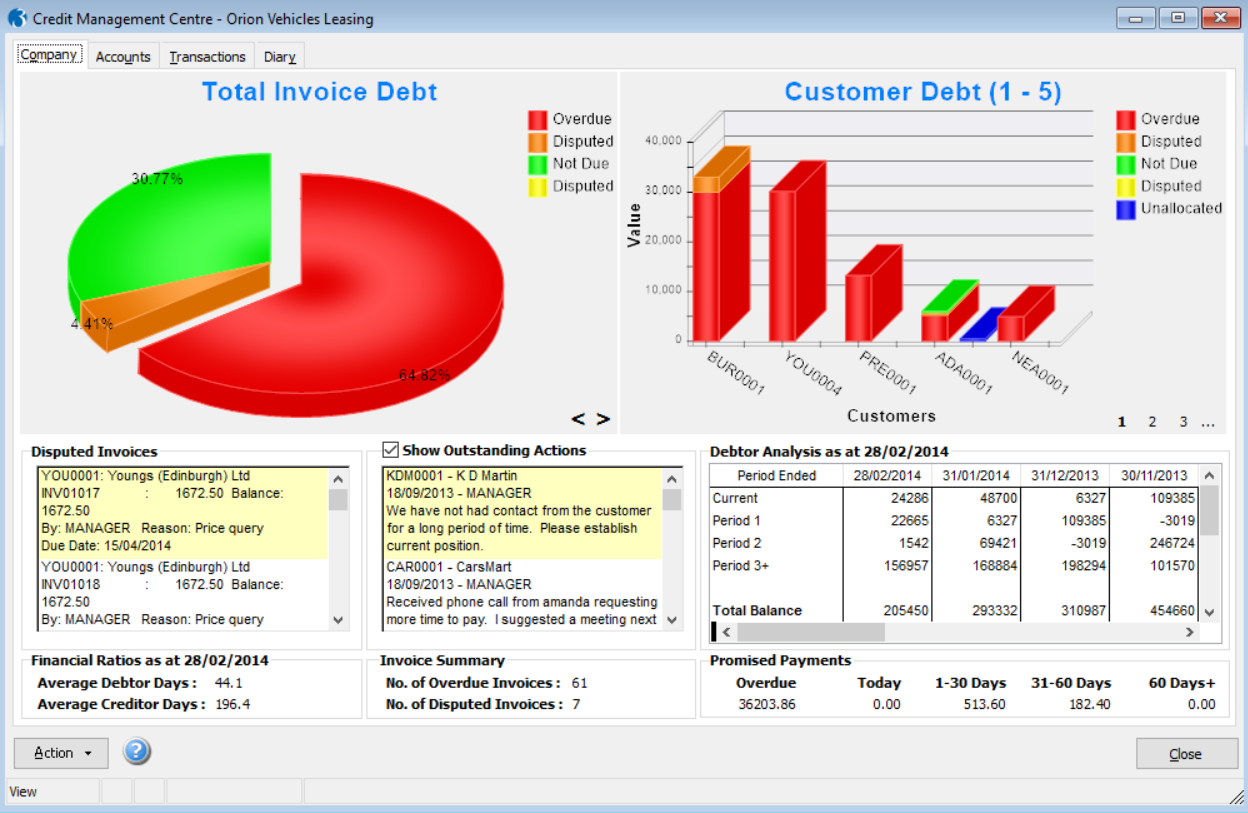

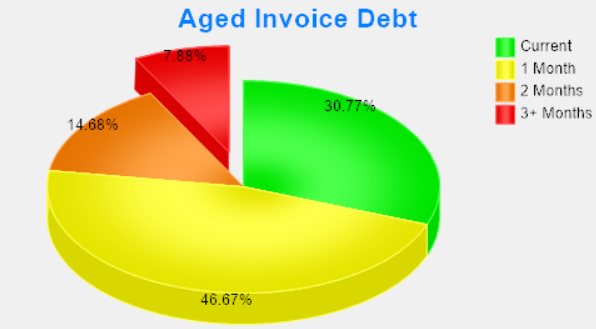

The Credit Management Centre in Opera 3 provides a centralised, easy-to-use tool which consolidates all of the information needed for effective credit control. Real-time graphs display your overall financial status so you can see what is owed, who owes it and how much money has been promised by customers. This gives you all the information you need to improve cashflow, reduce bad debt, make timely business decisions and improve the overall financial position of your business.

"The Credit Management Centre within Opera 3 is really useful as it enables us not only to ensure that our 16 day credit terms are adhered to, but helps to manage relationships and ensure we’re continuously in touch with our customers. We can invoice at the click of a button and chase payments as appropriate knowing that the right documents are at hand."

"The Credit Management Centre within Opera 3 is really useful as it enables us not only to ensure that our 16 day credit terms are adhered to, but helps to manage relationships and ensure we’re continuously in touch with our customers. We can invoice at the click of a button and chase payments as appropriate knowing that the right documents are at hand."

Amanda Paddick, OMSCo

There are a range of reports available, which can be exported to Excel, to give you a clear overview of your financial position. View across your selected date range to see actions that have been marked for follow up, promised payments, total debt per customer and much more.

Create up to nine levels of debtor correspondence, such as debt recovery letter templates to chase late payments.

Manage your cash flow, reduce customer debt and improve the overall financial position of your business with Credit Management Centre. It provides a consolidated view of your business so you can quickly see what is owed, who owes it and when, with easy to understand, real-time graphs.

Knowing who owes what and when they will pay is key to managing your customer debts. The Opera 3 Credit Management Centre is designed to improve your credit control processes which will help increase your cash flow, reduce bad debts and improve the financial position of your business. See it in action!